When you borrow money, it’s important to understand the interest rate policy that your lender may have in place. This policy will dictate how much interest you will be charge on your loan, and it can have a significant impact on the cost of your borrowing. In this blog post, we will explore what is a personal loan interest rate policy and provide examples of typical rates that you may be charge. By understanding the policy before borrowing, you can make inform decisions about which loan is right for you.

what is a personal loan interest rate

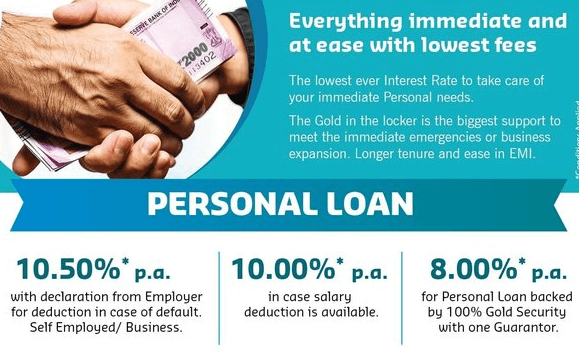

A personal loan interest rate policy refers to the financial institution’s state interest rate for personal loans. It is generally available during the loan application process and may be a part of the terms and conditions of the loan. Interest rates on personal loans can vary substantially, depending on a number of factors, including the credit score of the borrower, the loan term and amount, and whether or not the borrower is require to pay interest on weekends or holidays.

To ensure that you receive the best possible it is important to compare interest rates before applying. You can use online tools or lenders’ websites to find current rates and information about specific loans. Keep in mind that not all lenders offer a same. some may offer lower rates if you are approve for a longer term loan.

What is a personal loan interest rate policy?

A personal loan interest rate policy is exactly what it sounds like: a company’s policy on how much interest they will charge on personal loans. This is an important consideration for customers, as different rates can have a significant impact on the total cost of the loan.

Some companies might allow borrowers to pay extra if they want to lock in a lower interest rate, while others might have fix rates that don’t change regardless of the borrower’s credit score. It’s important to understand what your options are before taking out a personal loan, so you can get the best possible terms.

What are the different types of interest rates?

There are a few different types of interest rates when it comes to personal loans.

Fixed-Rate Loans: These loans have an interest rate that stays the same throughout the duration of the loan. This is often preferr by people who plan on keeping the loan for a long period of time, as it provides stability in their repayment process.

Variable-Rate Loans: With these loans, the interest rate can change over time, base on market conditions. This can be helpful if you anticipate changes in your monthly expenses, such as rent or groceries. However, it can also be more risky if you don’t have a good understanding of how interest rates work.

How do you calculate the interest rate on a personal loan?

The interest rate on a personal loan is determin e by a number of factors, including the terms of the loan and the credit score of the borrower. In general, banks and lenders will charge borrowers higher rates for loans with longer terms and higher credit scores.

Conclusion

Thank you for reading our article on what is a personal loan interest rate policy. In this article, we will be discussing the different types of interest rates that are available and how they work. We will also be providing tips on how to choose the right interest rate for your needs and discuss some common factors that influence rates. Hopefully, this information will help you make an inform decision when it comes to taking out a personal loan.