A good interest rate for a home loan can vary depending on many factors, but typically, a lower interest rate means lower monthly payments and less money paid out in interest over the life of the loan. There are many benefits to having a lower interest rate on your home loan, including the ability to save money on your monthly payments and over the life of the loan.

1) What is a good interest rate for a home loan?

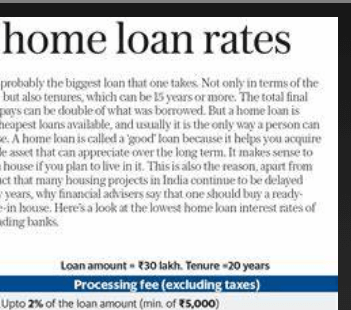

When it comes to taking out a home loan, one of the most important factors to consider is the interest rate. After all, this is what will determine your monthly repayments and how much you end up paying back in total.

So, what is a good interest rate for a home loan?

Well, that depends on a number of factors, including the current market conditions and your personal circumstances. However, as a general guide, you should aim for an interest rate that’s lower than the average rate on the market.

You also need to make sure that you can afford the repayments, which is why it’s important to compare home loans before making a decision.

2) The benefits of a good interest rate for a home loan.

When it comes to taking out one of the most important factors to consider. A good interest rate can save you thousands of dollars over the life of your loan, so it’s important to shop around and compare rates before you commit to a lender.

There are a few things to keep in mind when you’re looking for a good interest rate on a home loan. First, remember that the advertised rate is not always the rate you’ll actually get. Lenders will often offer a lower rate to customers with good credit scores and a stable income.

A good interest rate can save you thousands of dollars over the life of the loan. Be sure to compare rates from multiple lenders and don’t be afraid to negotiate in order to get the best deal possible.

3) How to obtain the best interest rate at earliest

When it comes to home loans, the interest rate is one of the most important factors to consider. A lower interest rate can save you thousands of dollars over the life of your loan, so it’s important to shop around and compare rates to get the best deal.

But how do you know if you’re getting a good interest rate? And what is a good interest rate for a home loan, anyway?

Here’s what you need to know about rates, and how to get the best rate for your situation.

For homebuyers in the US, a good interest rate is anything below the average rate. Rates are relatively low right now, so even a small difference can make a big difference over the life of your loan.

4.The Importance of Shop

A lot of people think that shopping is a waste of time and money. However, shopping is actually a very important activity that can help you save money and time. Here are four reasons why shopping is important:

1. Shopping helps you find good deals.

If you take the time to shop around, you can find good deals on almost anything. For example, you can find great deals on clothes, furniture, and even cars.

2. Shopping helps you save time.

If you know what you want, you can usually find it faster by shopping online or in a store.

Conclusion

A good interest rate for a home loan can vary depending on a number of factors, but typically, the lower the, the better. Some of the benefits of having a lower interest rate on include saving money on your monthly payments, and potentially paying off your loan faster.